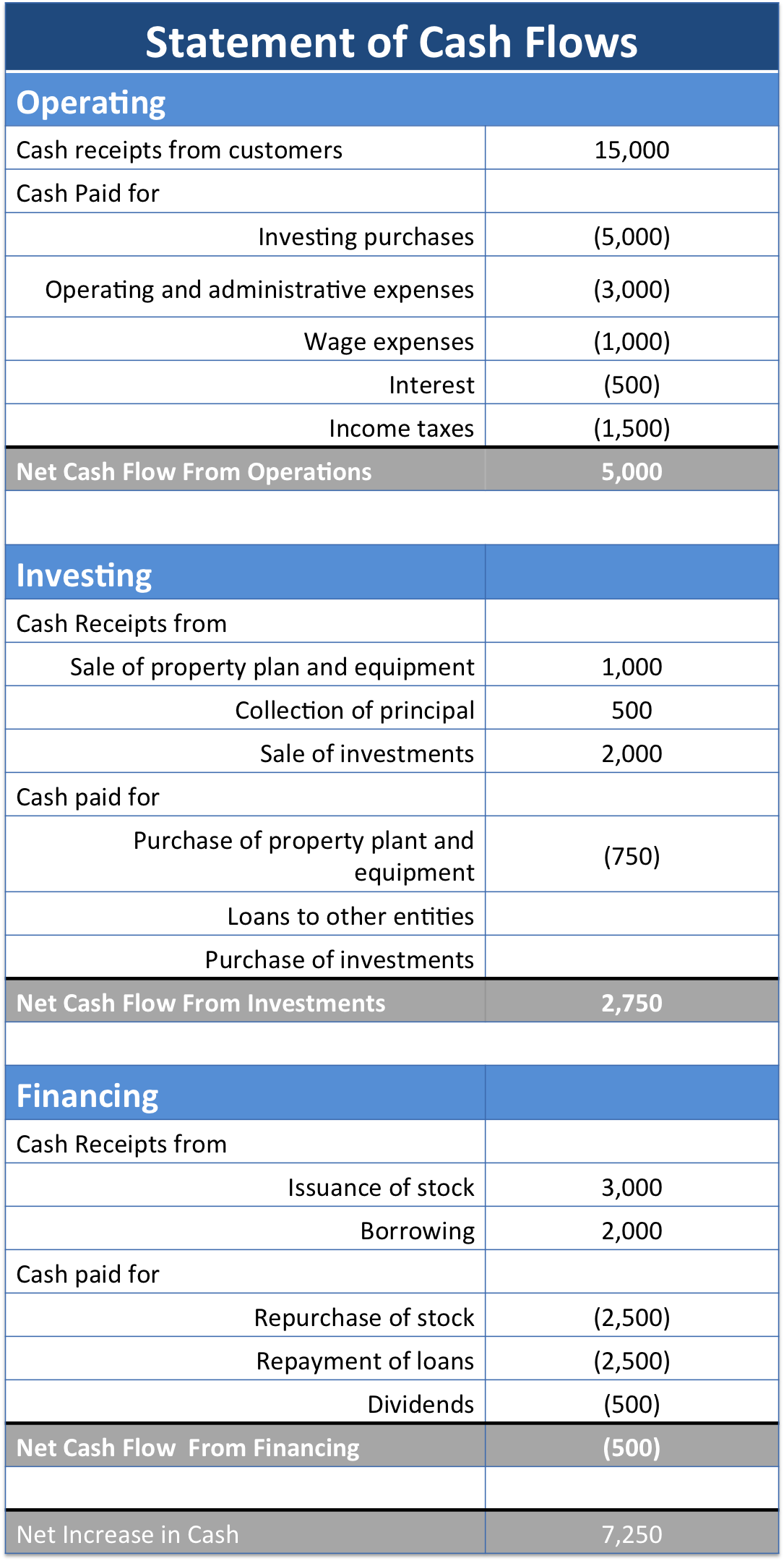

To generalize, cash from operating activities is generally linked to those transactions and events that enter into the determination of income. Cash outflows consist of payments for inventory, trading securities, employee salaries and wages, taxes, interest, and other normal business expenses. Operating, Investing, And Financing ActivitiesĬash inflows from operating activities consist of receipts from customers for providing goods and services, and cash received from interest and dividend income (as well as the proceeds from the sale of “trading securities”). In addition, businesses are required to reveal significant noncash investing/financing transactions. As a result, the statement of cash flows provides three broad categories that reveal information about operating activities, investing activities, and financing activities. One objective of financial reporting is to provide information that is helpful in assessing the amounts, timing, and uncertainty of an organization’s cash inflows and outflows. This required financial statement is appropriately named the Statement of Cash Flows. Rather than depending upon financial statement users to do their own detailed cash flow analysis, the accounting profession has seen fit to require another financial statement that clearly highlights the cash flows of a business entity. Sophisticated analysis will often reveal such issues. Or, a business may be paying dividends, but only because cash is produced from the disposal of core assets. On the other hand, a business may appear profitable, but may be experiencing delays in collecting receivables, and this can impose liquidity constraints. However, one cannot ignore the importance of cash flows.įor example, a rapidly growing successful business can be profitable and still experience cash flow difficulties in trying to keep up with the need for expanded facilities and inventory.

Accrual information is perhaps the best indicator of business success or failure.

Chapter 11: Advanced PP&E Issues/Natural Resources/Intangibles.Chapter 10: Property, Plant, & Equipment.Chapter 6: Cash and Highly-Liquid Investments.Chapter 5: Special Issues for Merchants.

Chapter 1: Welcome to the World of Accounting.

0 kommentar(er)

0 kommentar(er)